ATIDI seeks to increase its business in Senegal

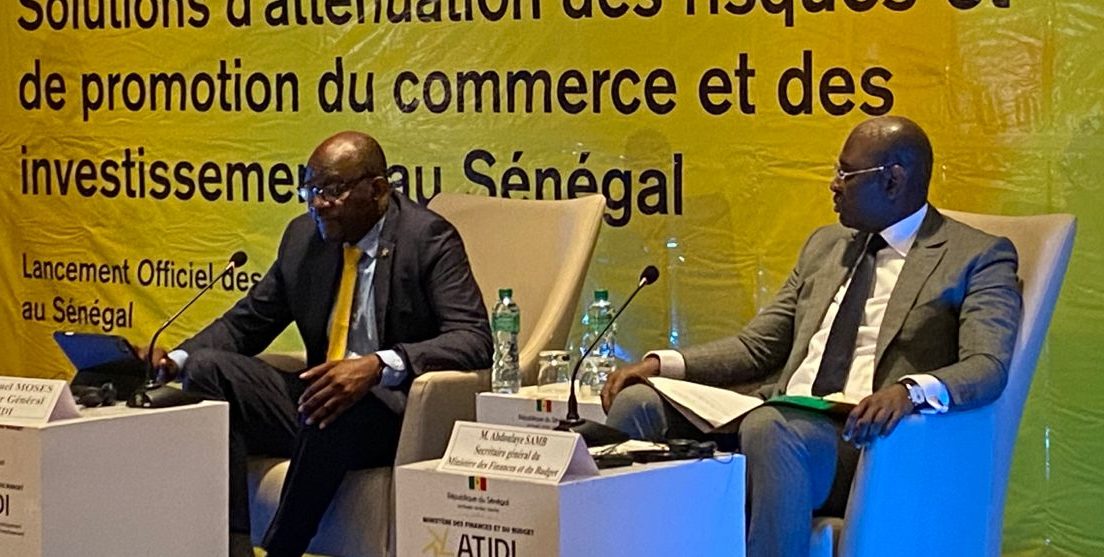

The African Trade & Investment Development Insurance (ATIDI) completed a workshop on “De-risking trade and Investments in Africa” during which it presented its risk-mitigation product range and discussed how Senegal could benefit from it with private investors, decision-makers and development partners.

The workshop was a highlight of ATIDI’s official launch in Senegal, during which ATIDI’s Management also met with several members of the Senegalese government, notably H.E. Mamadou Moustapha Bâ, Minister of Finance and Budget, to discuss how the organization can further support the financing of priority projects in line with Senegal’s national development framework, the Plan for an Emerging Senegal (PES).

“Senegal is a priority country for ATIDI. We are already engaging in the country, but are now looking to do more, in line with the development priorities outlined in the PES. We have had fruitful discussions with a large array of stakeholders in this respect and we are convinced that our unique offering and positioning as the premier pan-African provider of trade and investment development insurance will allow us to help catalyze private investment for the benefit of Senegal and its people,” Manuel Moses, CEO, ATIDI.

Welcoming ATIDI’s commitment to the country, Senegal’s Minister of Finance and Budget H.E. Mamadou Moustapha Bâ said 60% of the Plan for an Emerging Senegal is expected to be financed by private investments.

“In the present sluggish global and regional economic environment, achieving this ambitious goal requires offering investors attractive opportunities, but also solid guarantees against multiple risks. ATIDI is an essential partner in that space, as it offers investors an extra layer of security and so allows them to confidently pursue and even increase their engagements in projects that will transform our country and improve the well-being of our fellow citizens,” Hon. Moustapha said.

Senegal became ATIDI’s 20th member state in December 2021 with a subscribed capital contribution of EUR15 million, following financial support from the European Investment Bank (EIB).

To date, ATIDI has an active pipeline in Senegal valued at CFA 390 billion (USD658 million) in the energy and gas, financial and insurance activities & trade, and transportation sectors.

ATIDI has grown from operating in just seven countries in 2001, into a pan-African institution with 21 member countries, present across Africa with a significant global reach. ATIDI is now implementing its 2023 – 2027 corporate strategic plan which sets ambitious goals for the organization’s growth and impact on Africa’s development. The multilateral pan-African insurer recently rebranded from ATI to ATIDI, an identity that provides a better fit to its growing stature as the multilateral trade and investment insurer on the continent.

About ATIDI

ATIDI was founded in 2001 by African States to cover trade and investment risks of companies doing business in Africa. ATIDI predominantly provides Political Risk, Credit Insurance and, Surety Insurance. Since its inception, ATIDI has supported USD78 billion worth of investments and trade into Africa. For over a decade, ATIDI has maintained an ‘A/Stable’ rating for Financial Strength and Counterparty Credit by Standard & Poor’s, and in 2019, ATIDI obtained an A3/Stable rating from Moody’s, which has now been revised to A3/Positiv.

Source: Mike Omuodo/Senegal