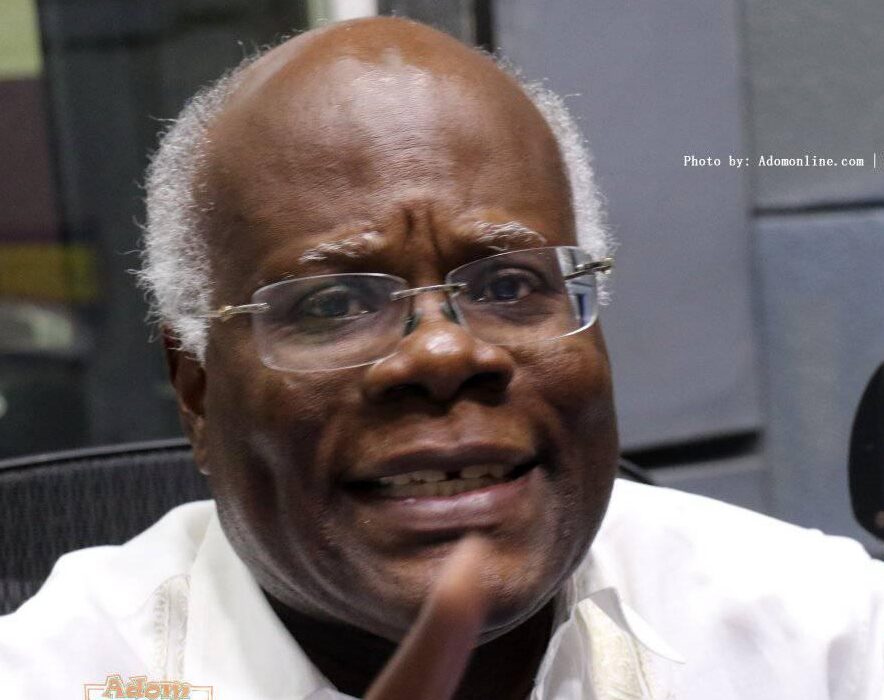

Trade Minister Unhappy over Delays in 1D1F Tax Waiver Approval

Hon. KT Hammond, the Minister for Trade and Industry, has expressed his disappointment over the delays in passing tax waivers for factories under the One District, One Factory policy.

He accused the Trade and Industry Committee of Parliament’s leadership of obstructing the approval process.

In his 2024 State of the Nation address, President Akufo-Addo appealed to Parliament to urgently consider approving outstanding tax exemptions from 2021 to send positive signals to the business community.

Speaking to Journalists in Parliament, the Trade and Industry Minister alleged that the NPP leadership on the Finance Committee is conspiring with the minority caucus to sabotage the approval of the tax waivers.

“Anything that they perceive will be in the interest of the country and coming from the NPP, their natural instinct is to rise against it.But on this occasion, it is not just only the opposition, there are also some elements in the NPP, on the committee’s leadership who are really creating problems and I have been fighting them inside and outside of Parliament to have the tax waivers issue resolved.”

The Ranking Member on the Trade and Industry Committee, Yusif Sulemena, stressed that the minority caucus will not approve any tax waivers.

“When we started passing those exemptions, it got to a point where we realized they were abusing them so we passed what we call the Tax Exemptions Act, and we want him to respect that act. If we were to go by that act, the exemptions he has brought us would not pass. There is no need to give any further tax exemptions because of the burden he has brought on Ghanaians when it comes to taxation.

The Bank of Ghana (BoG) has announced significant revisions to the balance and transaction limits of customers’ mobile money wallets, effective March 1, 2024.

This strategic move, as communicated by the Ghana Chamber of Telecommunications, reflects the evolving landscape of transactional activities and the shifting needs of consumers in the digital financial ecosystem.

In response to burgeoning transaction volumes and evolving consumer demands, the BoG has taken decisive steps to adjust both daily and monthly transaction limits across various tiers of mobile money accounts.

Under the new framework, the daily transaction limits for different account tiers have been adjusted upwards. Notably, the minimum account category, which previously had a limit of GH¢2,000, has been revised to GH¢3,000, reflecting a concerted effort to accommodate increased transactional activities.

Similarly, medium and enhanced accounts have witnessed substantial increments in their daily transaction thresholds, with the former climbing from GH¢10,000 to GH¢15,000, and the latter ascending from GH¢15,000 to GH¢25,000.

Moreover, maximum account limits have been revised upwards, signaling the BoG’s commitment to fostering greater financial inclusivity and flexibility.

The minimum account limit has been revised upwards from GH¢3,000 to GH¢5,000, while medium and enhanced accounts have seen their maximum limits rise from GH¢25,000 to GH¢40,000 and from GH¢50,000 to GH¢75,000, respectively.

The monthly transaction limits have also undergone recalibration, with the minimum account threshold being elevated from GH¢6,000 to GH¢10,000. In contrast, the medium and enhanced account categories continue to enjoy unrestricted monthly transaction values, reaffirming the BoG’s endorsement of digital financial empowerment across diverse consumer segments.

The revisions to mobile money wallet limits underscore the BoG’s proactive stance in fostering a dynamic and inclusive financial ecosystem, thereby propelling Ghana towards greater financial resilience and prosperity.